The EU Could Die (If It Fails To Reform)

Current Economic Crisis

Our previous development model is over. We are over-regulating and under-investing. Within two or three years, if we follow our default plan, we will fall out of the market. Mario Draghi has just published a report, and his tone seems very pessimistic - the Union may die, and we are one step away from a very important moment.

Emmanuel Macron announced on October 3rd at the Berlin Global Dialogue conference, in very pessimistic words, that in the economic sphere, we are talking about 27 different countries.

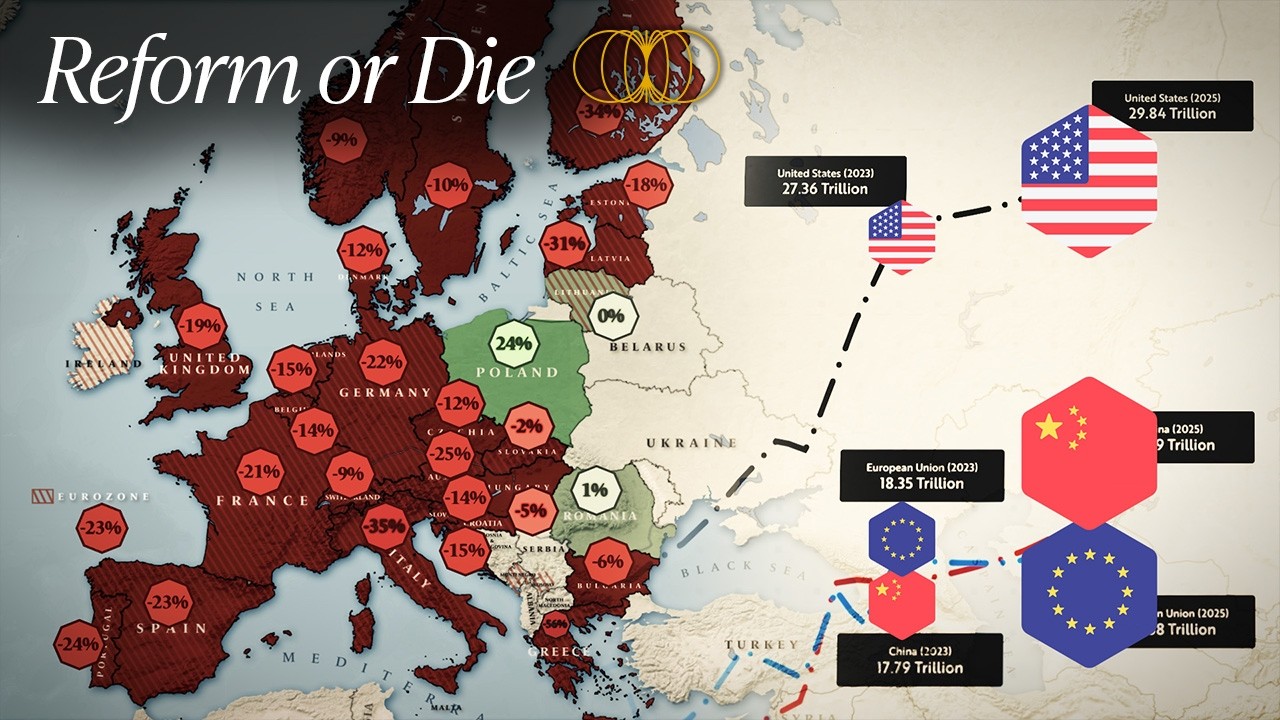

Comparative Economic Growth

Let’s look at the growth of real GDP (taking inflation into account) since the financial crisis of 2008 and compare it with the US. On this map, originally published on Platform X by Oxford Economics economist Daniel Kral, we see the cumulative growth of the last 16 years adjusted for inflation.

Poland plays in a different league with real GDP growth of 60% in Central and Eastern Europe. But in relation to the US, the engine of Europe is a full 20% behind America - an enormous gap.

These changes can be seen even more clearly in the chart of nominal growth. According to the World Bank, in 2008 the Union had a larger GDP than the United States (16.3 trillion versus 14.8 trillion), although it gained some advantage by adding new members from the east of the continent.

Since then, however, the Union has grown by only 2 trillion in nominal terms, while America has almost doubled the value of its economy.

Competition with China

America is only one point of reference. As recently as 2000, the Union’s economy was nearly 7 times larger than China’s. It took only 23 years for it to become equal in size and soon to be smaller than China’s. That tectonic shift happened in just one generation.

Yes, China has its own problems - from its real estate sector to its investment sector to its demographics. But even pessimistic growth forecasts talk about growth rates for China that are at least two to three times higher than the European Union’s.

Voices of concern about the death of the European Union will grow louder - voices which, let us not forget, can already be heard from time to time, albeit for the moment from more radical groups.

Vulnerability and Decline

Will Europe, which is rich after all, experience what usually happens when a former power can no longer hide its inertia and vulnerability? A power that for centuries has accumulated enormous wealth on its territory? Because then there are always actors and states who, sensing weakness, step in and take what they feel like.

Growth in Europe has been slowing for a long time, but we have ignored it until now. “I would say that 2 years ago we wouldn’t have a conversation like the one we are having here today,” Mario Draghi said at a special press conference in Brussels on September 9th, 2024.

The Draghi Report

Earlier, European Commission President Ursula von der Leyen gave a longer speech announcing their report prepared under the auspices of the former head of the European Central Bank and then Prime Minister of Italy.

The report has quite unintentionally shown one of the problems of the community, which is the unequal treatment of old and new members. The newer EU members have grown much better than the members of the old Union over the last 16 years.

However, the report itself seems to be an accurate diagnosis of the symptoms of the disease consuming the community in the economic field. Mario Draghi described it as an “existential challenge” for the Union.

Those present at the press conference heard that without restoring their economic competitiveness, the countries of the Union “will not be able to be a leader in new technologies, a model of climate protection, and an independent actor on the world stage.”

Key Weaknesses Identified

In Draghi’s report, the diagnosis he announced at the conference has been deepened and documented in detail. A picture of the Union’s greatest weaknesses emerges:

- It lacks large companies capable of competing with Chinese and American giants, especially in sectors that drive growth

- Productivity (the labor productivity index) in the EU is already in negative territory compared to the United States

- ”If the EU were to maintain its average productivity growth rate since 2015, it would only be enough to keep GDP constant until 2050,” the Draghi report warns

It warns that if this indicator does not improve, the community’s GDP will start to shrink. Meanwhile, labor productivity is closely linked to innovation and the creation of new technologies.

Europe must rise to this challenge because it cannot afford to remain in the mediocre technologies and industries of the last century. This is proving very difficult due to the deterioration in the quality of training of technical personnel capable of participating creatively in the AI revolution.

Moreover, instead of creating favorable conditions for the development of AI, the Union is primarily concerned with regulating it.

Energy Challenges

The report states: “The EU must help shift power generation towards secure, low-cost clean energy sources, but fossil fuels will continue to play a central role in energy pricing at least for the remainder of this decade. Without a plan to transfer the benefits of decarbonization to end users, energy prices will continue to weigh on growth.”

Interestingly, the report also claims that the European Union remains a world leader in clean technologies such as wind turbines, electrolyzers, and low-carbon fuels.

Geopolitical Vulnerabilities

From the diagnosis of the main economic malaise of the Union, Draghi’s report moves to the lurking dangers that may intensify in the future. The list of dangers begins with the growing risk of geopolitical upheaval:

- Wars and conflicts weaken willingness to make long-term investments

- They stifle international trade and can ultimately disrupt supply chains

- Europe is particularly vulnerable to the consequences of such events

A very telling statistic is that the Union as a whole spends a total of around €240 billion a year on defense. This includes arms purchases, salary payments, living costs, and research and development. Only the United States spends more in this area. Without concerted efforts and closer cooperation, Europe seems to be completely defenseless.

The old continent’s position in the world is also weakened by:

- Fragmentation of the capital market

- Excessive bureaucratic regulations

- Lack of coordinated economic policy

Historical Parallels: British Empire’s Decline

The second of the great transformation processes will relate to the last quarter-century of the European Union. Let’s start with the empire that lost at its own request, namely Great Britain.

At its peak, Britain controlled a quarter of the world’s land area and subjugated about a third of the world’s population. From the mid-19th century, however, the Empire rolled down an ever-accelerating slope. Even as it continued to expand its territory, it also found itself among the winners of two world wars, after which it simply disintegrated as Britain lacked the strength to continue holding it together.

If you are looking for an answer to the question of how this happened, focus on two terms: technological revolution and free trade.

Technological Innovation and Regulatory Failure

The Crystal Palace exhibition, with its vastness and modernity, conveyed the grandeur of the Empire to the 9 million tourists who came from all over Europe. Inside, according to reports in the European press, there was a “battle of nations in the field of modernity.” More than 6,000 of the nearly 13,000 exhibits were occupied by British industries from all over the Empire.

However, industrialists from Prussia and other German states who exhibited their products there made a strong impression. Shortly thereafter, German steel was proving to be superior to British steel - a strategic product and important building material for its time, used to make rails, viaducts, bridge spans, building frames, and the most important components of machines, ships, and weapons.

The British had exclusive access to several groundbreaking inventions. As early as 1827, designer Walter Hancock patented a lightweight steam boiler. Two years later, he presented a vehicle powered by this boiler that could carry up to 10 people and their luggage. Over the next decade, companies began to spring up in England using steam omnibuses to transport passengers and goods where locomotives could not.

However, complaints about how these vehicles frightened horses, damaged road surfaces, and caused other problems intensified in the press. The media campaign was sponsored by railroads and freight companies that used horse-drawn stage coaches. They had far greater financial resources than the omnibus manufacturers who were not yet established in the market.

Politicians therefore sided with the more powerful lobby and its associated newspapers. This resulted in stricter laws regulating the participation of steam vehicles on public roads. The most restrictive was the requirement to stop and assist horses and horse-drawn vehicles passing by. Violation of these regulations was punishable by a fine of £10 (about £1,000 today).

The new law took away the main strengths of the omnibus - speed and mobility. When it came into force, all the companies that used them went bankrupt.

Free Trade Policies

Just a dozen months after the British government prevented the birth of an automobile industry in the country, Nicolas Otto unveiled his internal combustion engine at the Paris exhibition.

The United Kingdom also abandoned the use of tariffs. This opened up new markets for British manufactured goods. Their quantity and cheapness meant that wherever they went, they effectively stifled the development of local industry. When a country tried to protest, Royal Navy ships would appear, and the desire to protest would pass.

In the second half of the 19th century, however, the situation changed radically. Industrial production grew rapidly in Germany and the United States. At the same time, both superpowers raised tariffs to protect their own industries. British politicians began to worry: “We are now losing control of our colonies and dependencies, which are gradually falling into German hands. German goods are going to India, Canada, Australia on the same terms as English goods.”

Some demanded: “To the extent that a foreign country excludes our goods from its markets, to that extent should we penalize its goods in our markets.” Successive British governments, however, preferred to adhere to the free trade doctrine even as other powers turned away from it.

The European Union’s Current Predicament

At the beginning of the 21st century, as in the case of the British Empire, we see a huge political and economic creation that is neither a unified state nor a unified economic organism, although it is sometimes perceived as such - the European Union. It is already too integrated to be considered just a loose association of independent states but is also very far from being able to function as if it were a single state.

The European Parliament stated in 2000: “The aim is to make the European Union the most competitive and dynamic knowledge-based economy in the world, capable of sustainable development, creating a greater number of better jobs and developing greater social cohesion.”

Yet over the next 5 years, despite spending and new directives from the European Commission, instead of overtaking the United States and China in the field of innovation, the European Union fell further and further behind.

Failed Reform Attempts

As early as 2005, the EU recognized that the Lisbon strategy wasn’t working. Former Dutch Prime Minister Wim Kok was appointed chairman of a group of experts tasked with reviewing the strategy. His report was somewhat reminiscent of the Draghi report - it bluntly stated that things were bad and something needed to be done.

The European Commission proposed a new start for the Lisbon strategy, focusing on two main tasks: ensuring stronger sustainable economic growth and creating more and better jobs. But ultimately, all the bureaucratic and regulatory efforts stifled development.

Just as Britain began to feel the effects of the “red flag act” not a few years after its introduction but three decades later, the same happens in the case of Europe today. The EU is stifling development, and that will be felt for decades to come.

The problem is that neither the Union as a whole nor the countries that make it up have proven capable of implementing much-needed changes. The diagnosis was correct, the patient is sick, the disease was aptly named, but the treatment was never implemented.

Climate Policies and Economic Impact

In 2009, the European Union committed to the “20-20-20” plan: to reduce CO2 emissions by 20%, to increase energy efficiency by the same amount, and to meet at least 20% of market demand with electricity from renewable energy sources.

The European Commission was tasked with drafting directives specifying the changes needed to achieve this strategic goal. At the same time, fundamental changes were taking place in the European Union under the aegis of Chancellor Angela Merkel with the ratification of the Lisbon Treaty.

In December 2015, 195 countries concluded an agreement to radically reduce greenhouse gas emissions, with the determination of US President Barack Obama and the support of Germany and France. The document was later quickly ratified by the European Union.

All countries were to participate in reducing emissions of carbon dioxide and other greenhouse gases to “save the planet.” This meant using brand new equipment based on innovative technologies, converting energy systems to intermittent renewable energy sources.

The EU’s long-term budget combined with the Next Generation EU (a temporary instrument to stimulate economic recovery) is “the largest package of measures ever funded in Europe, a total of over 2 trillion EUR in current prices,” the European Commission boasted on its website.

Current Challenges

Russia used fossil fuels as a weapon even before the armed invasion drove up the prices of natural gas and oil, with a strong impact on EU economies led by Germany. Thus, there was a growing number of circumstances that threatened to push the community into an even faster downward spiral on the economic front. The Draghi report only confirmed this.

To summarize the effectiveness of the European Green Deal strategy on the economic front, one need only look at the key economic sectors that were supposed to be transformed:

“Regulatory uncertainty and the inability to adapt to real-world events further weakens the competitiveness of the automotive sector,” warns the ACEA on its website. This is borne out by the huge wave of job cuts and car plant closures that is beginning to sweep across Europe.

The Volkswagen group plans to lay off up to 30,000 workers in Germany, while considering increasing production capacity at its factories in China. In the Italian factories of the Franco-Italian-American Stellantis group, a general strike has begun.

While the EU focuses on a reduction in greenhouse gas emissions and a shift away from fossil fuels with its “Fit for 55” program, China has BYD, SAIC, GAC, and many other giant corporations, with government support providing them with enormous subsidies and tax breaks.

So it is the European community that has become a market and an area of expansion for Chinese companies, while the Chinese market is becoming more and more closed to European products. This leads to a gigantic trade imbalance. Between 2013 and 2023, the trade deficit between the EU and China has grown from €100 billion to over €400 billion.

Existential Threat

Another Lisbon strategy debacle is in the pipeline, and we even have a report analogous to Wim Kok’s in 2005. The problem is that this time, the consequences of failure could be far more dramatic, even threatening the very existence of the European Union.

An economic collapse will generate such great social tensions within and conflicts between member states that they could tear the entire Community apart from within. It is therefore necessary to increase the competitiveness and innovation of the EU.

Reform Attempts

”We need to ensure that companies, especially smaller ones that want to grow faster, have access to adequate financing,” said Pascal Donohoe, chairman of the Eurogroup of EU Finance ministers in Gent.

However, the creation of a common EU capital market is being blocked by Berlin, which fears the loss of Germany’s advantage in the EU due to its financial resources.

According to the Draghi report, three other areas are key:

- The European Commission should issue EU joint debt, like the one that made it possible to finance the recovery and resilience plans. It would allow €800 billion a year to subsidize the energy transition and support industry, helping to withstand Chinese competition.

- The problem is that the European Commission’s previous joint borrowing for the recovery plans is itself problematic - this enterprise was supposed to help the community countries hit by the pandemic to recover.

- The US is countering Chinese industrial policy by imposing a 100% tariff on Chinese electric cars. Similarly, Europe may try to protect its market from Chinese expansion, but raising tariffs means an analogous response from the other side.

Meanwhile, Germany has enjoyed economic growth over the past two decades largely because of free trade, mainly with China. The EU needs protectionism to defend itself, but Berlin cannot afford to risk it. This situation is best illustrated by the conflict over tariffs on Chinese electric cars - Berlin has tried to block them.

Innovation Challenges

The lack of large companies in Europe that have grown based on disruptive technologies is well illustrated by the example of electric car manufacturer Tesla, whose market value is currently estimated at $769 billion - twice as much as Ferrari, Porsche, Mercedes, BMW, Volkswagen, and Stellantis combined.

Founded by two investors, the company was taken over in 2004 by Elon Musk, who initially invested only $6.5 million. Since the financial market is delighted with Open AI and values it at $80 billion (expecting generous profits in the future), it is impossible to repeat this way of giving birth to a new technological corporation within the borders of the European Union.

Capital markets are broken, investors trust visionaries only after they move to the US, and the European Commission makes sure that large monopolies do not appear on domestic markets (unlike the tech giants of Silicon Valley).

The continental domination of the community by the largest states does nothing to increase the competitiveness of its economy and its innovation. This is all the more true in view of the aggravation of the conflict between Paris and Berlin, where France, following the example of the United States, wants to defend its industry with tariffs, while Germany favors free trade.

Therefore, the biggest weakness of the Draghi report is its failure to take these realities into account.